March 16, 2020

The Real Estate Market Will Shift, But It Won’t Be Like The 2008 Crash

The housing market crash of 2006-2008 was one that many of us still remember. People lost their jobs, homes, and livelihoods as the economy went into “The Great Recession”. The Coronavirus is going to cause the housing market to shift, but there’s evidence that this will NOT be like the 2008 crash.

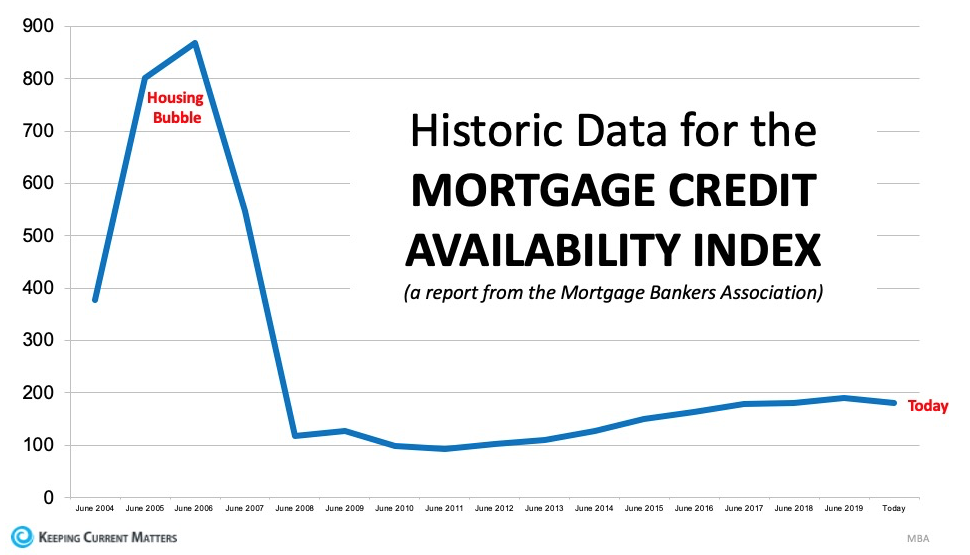

Mortgage Standards Have Changed

If you were an home-buying or selling adult in 2008, you probably vividly remember the lending qualifications, and how…weak…they were. In most cases, it was easy to get a mortgage, and in some cases you didn’t even have to prove your income.

Today, mortgage standards are much stricter. The Mortgage Banker’s Association releases a Mortgage Credit Availability Index, which basically states that the higher the index, the easier it is to get a mortgage. Even with loosened standards since the ’08 crash, it’s still tougher to get a mortgage today than back before the housing bubble started.

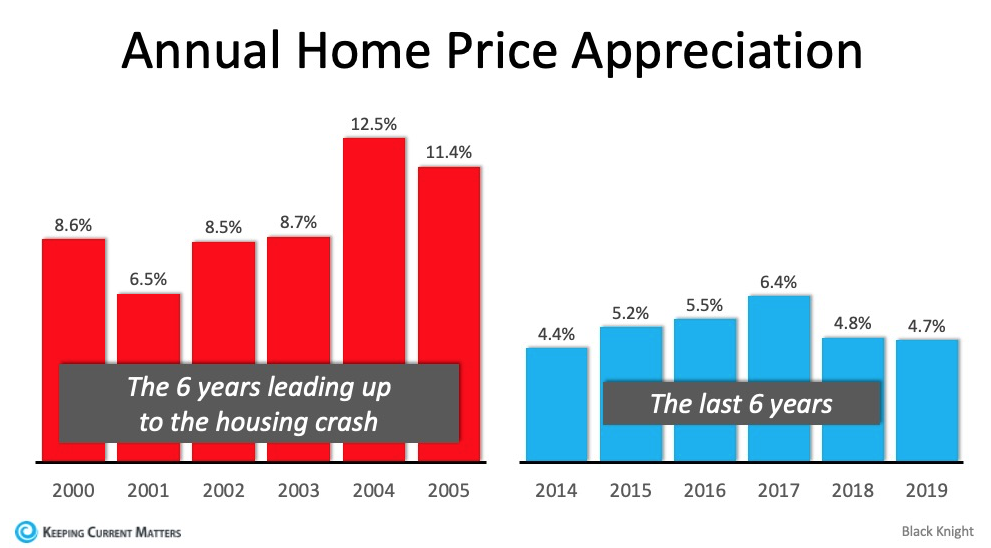

Home Prices Aren’t Skyrocketing

In the years leading up to the housing bubble bursting, home prices were increasing at a break-neck pace. “Normal” price appreciation is 3.6%, but during the housing bubble, homes were increasing at 4x that pace.

While the last few years have seen strong growth in home values, it’s not nearly the rocket ship it was during the housing bubble.

Market Inventory Remains Low

A “balanced” real estate market is when there is a 6-month supply of homes as inventory. This means that if no new inventory came to the market, it would take 6 months to deplete inventory with all else being equal.

In the lead up to the housing market crash, there was a surplus of inventory of over 8 months. When the housing bubble burst, home values tumbled due to the surplus in inventory.

This time around, the vast majority of areas are in a strong seller’s market, with less than a 6 month supply. This lone fact should support prices to steadier than what we saw back in 2006-2008!

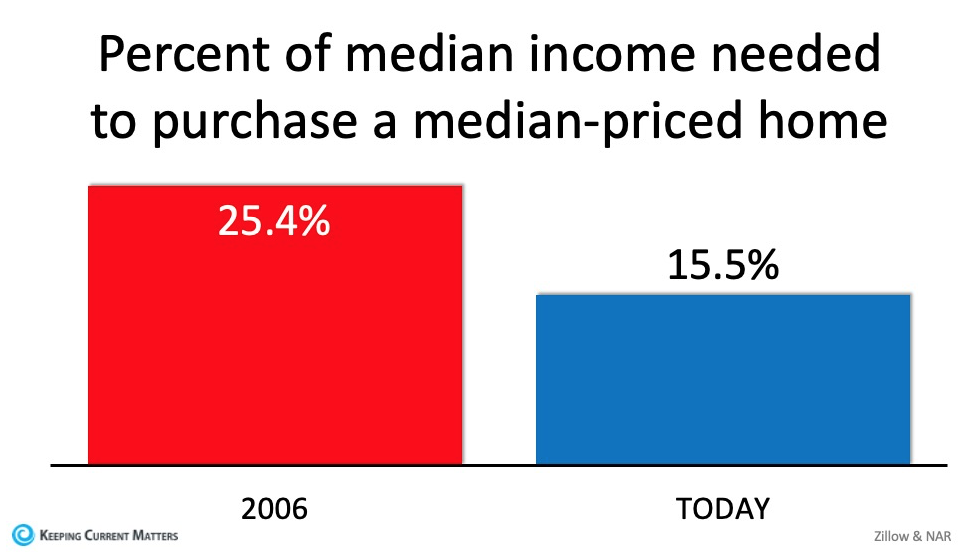

Homes Were Too Expensive To Buy

Historically low interest rates are helping to make home ownership more affordable. The affordability formula has three parts: the home price, the wages earned by purchaser, and the mortgage rates at the time.

In 2006-2008, home prices were relatively equal (adjusting for inflation) to what they are now, BUT mortgage interest rates were roughly double what they are now. Wages have also increased too, so the result is that the median income need to purchase a median-priced home has dropped by nearly 10% since the housing bubble!

Homeowners Have More Equity Than Before

In the run up to the housing market crash of 2008, the increase in home values led to many people having increases in the equity they have in their homes. During that time, many people were using their home’s equity like an ATM and withdrawing money out for other things.

When the market crashed, the equity shrank, and too many people found themselves in a negative equity situation (upside down) on their mortgage. That led to many homeowners walking away from their mortgages, which then led to an influx of foreclosures. Those homes sold at big discounts, and thus the surrounding home values dropped as well.

In 2020, the amount of equity cashed out is FAR lower than it was from 2005-2008. In fact, it’s down nearly 600 billion dollars from last time!

The Bottom Line

This market shift is NOT like the housing market crash from a little over a decade ago. It’s *still* a great time to sell your home and there are still plenty of buyers out there ready!

If you’re wondering what your home is worth, I can help with that! Get a free, no obligation value on your home right here.

Thank you!

I'll be in touch with your shortly. if you need to get ahold of Matt earlier please call him directly at 717-585-4522